The Swan With Two Necks

-

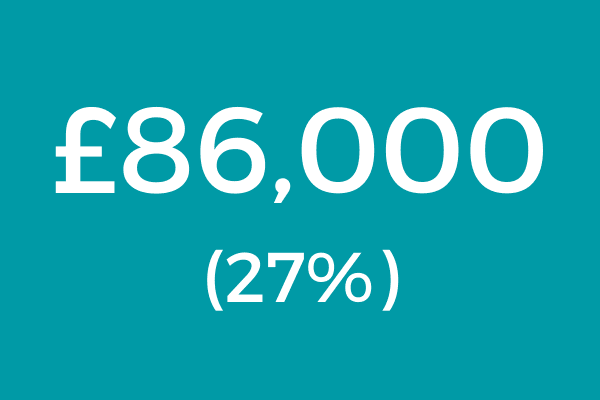

Refurbishment cost

-

Structures & Buildings Allowances identified

-

Total capital allowances

-

Total immediate tax savings achieved

Red House

-

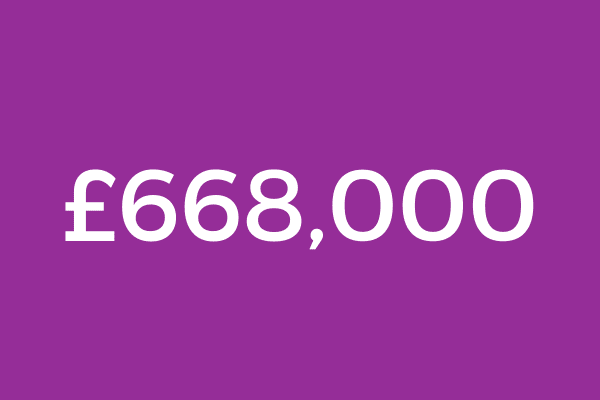

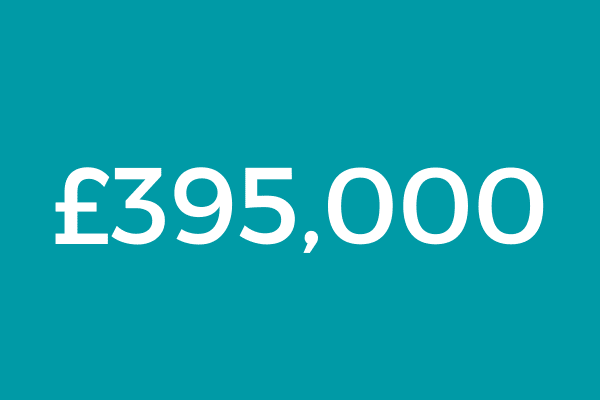

Refurbishment cost

-

Structures & Buildings Allowances identified

-

Total capital allowances

-

Total immediate tax savings achieved

Examples of some of the embedded qualifying items that we found...

-

Fixed bench seating

-

Room partition screening

-

Fitted storage units

-

Non slip flooring tiles

Other Case Studies