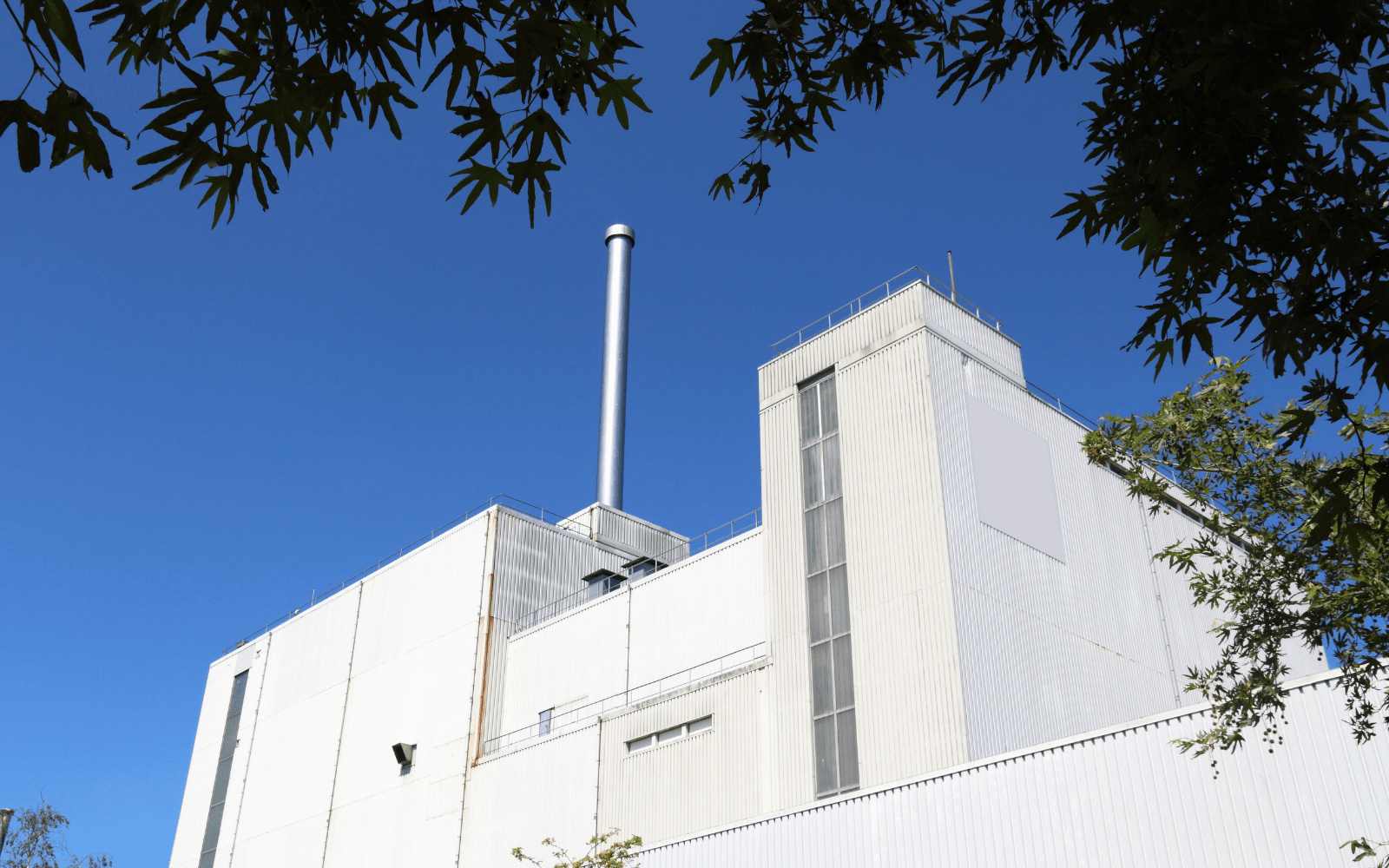

The client is a food manufacturer with a substantial premises. Due to increased demand, the business completed an extension in 2019 to the factory incurring significant costs.

The extension cost £1.3m in total (Land & Buildings only) which spanned across two financial years. Although elements of the expenditure were well detailed and could be treated accordingly by the client’s accountants, a significant amount of the costs were paid via Stage Payments and entirely restricted the accountants.

Our process, which includes visiting the premises and carrying out a detailed survey of the works completed, enabled a substantial amount for additional capital allowances to be secured.

This is a great example of how working closely with good accountants ensures clients maximise the available tax relief against their costs.

Other Case Studies