Key Dates

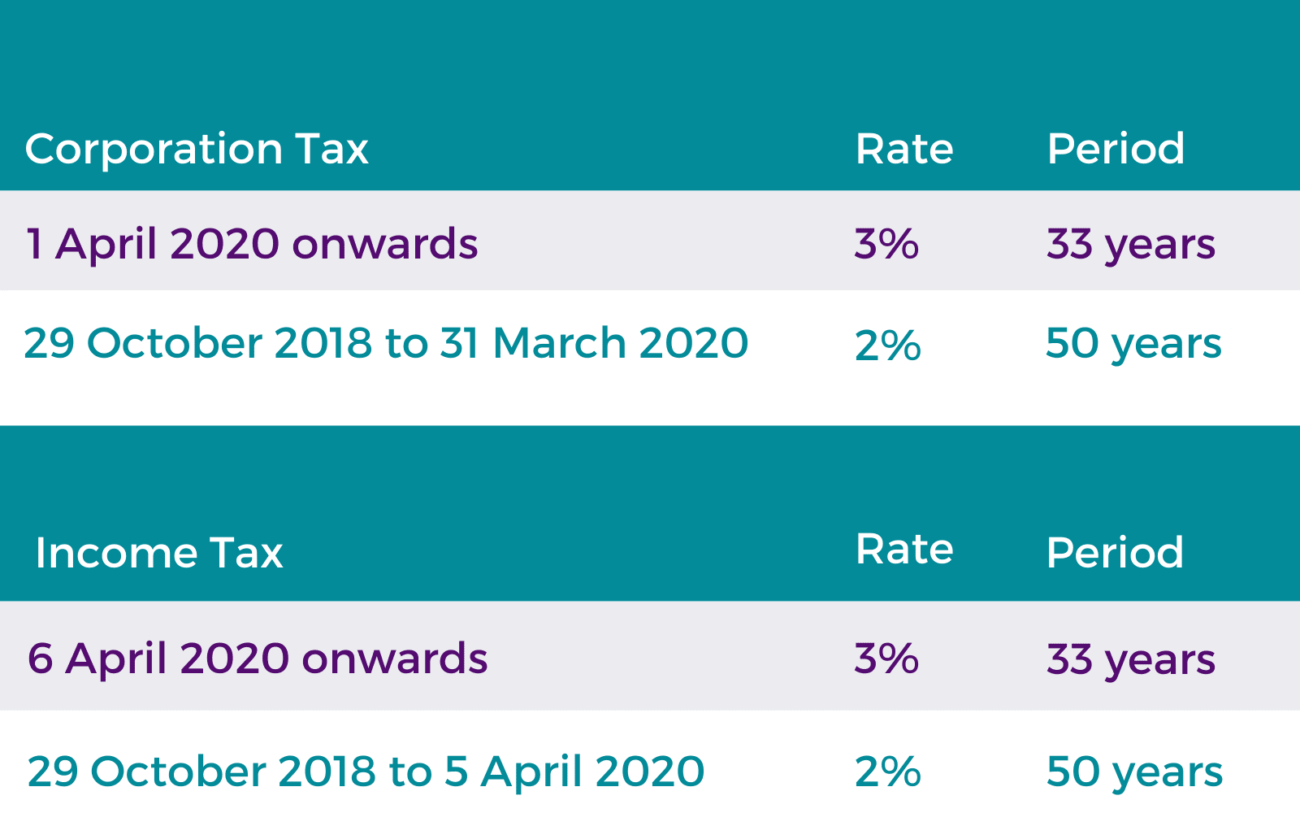

This relief and allowance program has come into effect for projects that commence on or after 29 October 2018. Take the time to research the measure because the provisions for commencement are complex and unique. There are anti-avoidance measures that keep taxpayers from manipulating the relief.

If you entered into your contract before 29 October 2018, including any preparatory work, you might be disqualified. The physical construction works need to be agreed upon after that date if you want to ensure that you can qualify for this relief. It is worth noting that HMRC advise that they will classify even an email as “contract” if it specifies that work will take place.

The relief becomes available from when the building or structure is bought into use, or when the work is completed if the building is in continuous use during the work carried out. There are further rules to consider if the building ceases to be used for a period of time.

July 2021 Update

An HMRC amendment states that if further assets are purchased upon which SBA is being claimed, then the date of purchase of the new assets should be shown on the Allowance Statement.